For decades, the Middle East has been one of the top destinations for European expats to live and work in. While this remains true to this date, there has been a surge in popularity of South East Asian countries as a hub for expats, particularly due to the attractive weather conditions and the relatively low cost of living in comparison to Europe.

For instance, on the last report of 2021 for 2022’s top countries to expatriate, 3 countries from South East Asia are in the top 10 expat destinations. Taiwan is ranked 1st, following by Malaysia 4th while Vietnam is the 10th destination for expats.

Along with these higher rankings, European expats have flocked to the South East Asian region. However, the majority of expats take the living conditions and the tax-friendly income for granted, which results in setting aside insufficient savings to cover their expenses in retirement or to support their children’s education.

Investing is the key to ensure a smooth transition to retirement, and this can be achieved either by investing through a financial advisor or using an overseas pension scheme.

The different types of pension plans available

Offshore pension plans are very popular investment vehicles among many European expats living in different parts of the world. These plans are typically constructed in a way to help employees and contractors working outside their home countries to save and invest money.

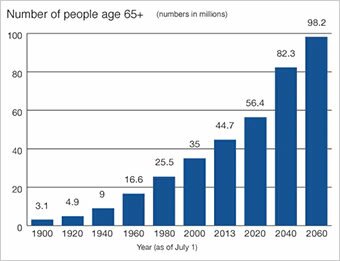

What will be the impact of the increase of people over 65 years old on our retirement pensions ?

The stand out benefits include the massive tax advantages of moving the pension out of the home country, the ability to fund the pension scheme from anywhere in the world, the flexible nature of contributions that enables expats to either increase or decrease their investment amounts periodically, and the availability of a plethora of investment options including stocks, bonds, mutual funds, and exchange-traded funds.

Generally, an offshore pension scheme is set up in a tax-friendly jurisdiction to pass on these benefits to European expats.

Regulatory changes remain the primary concern for expats who use offshore pension schemes to manage their investments. The documentation process to transfer a local pension to an offshore one could also be a concern, but many pension advisors do this on behalf of their clients.

The importance of investing early

According to data from Reuters, 52% of millennials have less than $1,000 in savings at present, which suggests that today’s professionals are not saving enough to support future expenses. Further, the American Stress Institute claims that 23 of the 43 most stressful life events occur at or near retirement, which highlights the importance of growing the savings pot throughout the working life of an expat.

The importance of starting to invest early cannot be emphasized enough. Whether it be saving for retirement back in the home country or to support the higher education of a child, starting early would almost always deliver the best results.

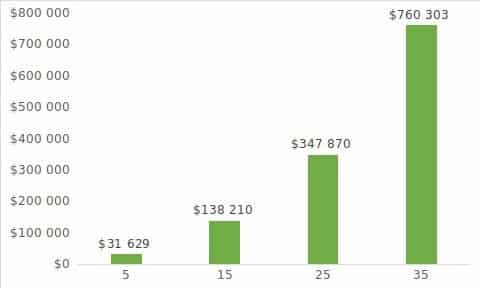

The illustration below plots the investment value of $5,500 saved annually, earning a return of 7% per annum.

Cumulative Effect : yearly savings and interest rates

As evident, longer the investment time horizon, longer the compounding effect can work its magic for an investor. It’s important to plan and start investing early to reap the best benefits of the investment process.

Being interested in investing, taking your first steps and even starting by making fictitious investments through a demo account are the tips you could give to a beginner who wants to get started.

The rule of 72: a simple formula to calculate investment returns

An understanding of the famous Rule of 72 can become very useful for an expat who is considering following an investment strategy to achieve investment objectives.

The Rule of 72 is a simple formula used to calculate the number of years it would take to double an investment amount, at a given interest/growth rate.

For example, if the rate of return from an investment is 9%, the number of years it would take to double the investment can simply be found by dividing 72 by 9 – which is 8 years.

Financial planners use this Rule of 72 as a simple tool to evaluate the attractiveness of different investment opportunities.

A permanent portfolio strategy to help ride all market conditions

There are many investment strategies to choose from and the key is to embrace a strategy that helps investors achieve their investment objectives. It’s important to distinguish between the available investment strategies as well. An investment strategy that suits one investor might not be ideal for another investor, which highlights the personalized nature of these investment strategies.

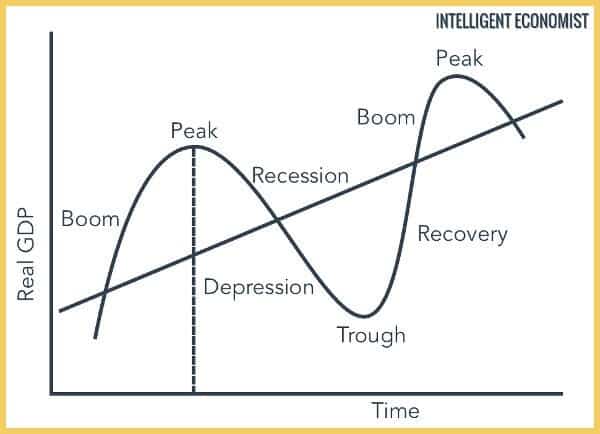

Therefore, the best practice for an investor is to clearly define the investment objectives, investment time horizon, and risk tolerance before deciding on which investment strategy to follow. Answers to the above questions would help an investor realize the rate of return that he would want to achieve and the level of risk an investor would be comfortable with. Some of the most popular investment strategies include value investing, growth investing, and contrarian investing. Arguably, these strategies provide varying investment returns during the 5 different stages of the business cycle.

Illustration of the business cycle

Business Macro Economy – Source: Intelligent Economist

For instance, growth strategies tend to outperform value when the economy is booming.

The non-permanent nature of employment contracts offered to Europeans in South East Asia might hinder the ability of an investor to use a high-risk strategy. Therefore, the best alternative would be to use a permanent portfolio strategy.

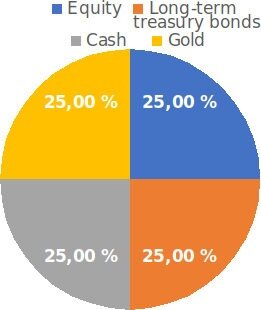

Harry Browne permanent portfolio with asset allocations – Source: Investopedia

By definition, these types of strategies are used to generate sufficient returns during all stages of the business cycle.

Harry Brown, who first introduced this strategy, had below asset allocations to help weather all economic conditions.

Harry Browne’s approach is based on a careful choice of asset classes with:

- 25% in shares to be enriched during prosperity

- 25% in long-term bonds to be hedged during deflationary periods

- 25% in precious metals to protect against high inflation

- 25% in cash to stay alert in case of crash and recession

Since money only circulates on the financial markets : when investors stop looking to an asset, investment funds and banks, they will position themselves on other assets.

Building a permanent portfolio as an expatriate living in Southeast Asia is an excellent way to build up your assets and secure your savings. Most of these emerging markets are large and full of business opportunities, but it is always better to keep our economies and pensions in a foreign offshore account.

Holding on to cash or other highly liquid asset classes enables an investor to bank on attractive investment opportunities as and when they become available. On the other hand, the investment in gold provides a sufficient level of diversification to the portfolio as gold has a very low correlation with equity markets.

Building a permanent portfolio as an expat living in South East Asia is a great way to build your wealth and secure your savings. Most of those emerging markets are great and full of business opportunities but it is always better to keep our savings and pensions on a foreign offshore account.

Combining a smart approach of being an expat in an emerging country such as Vietnam, Cambodia or Thailand and using offshore wealth growth solution is good combination to fully enjoy your life in a daily basis while keeping an eyes on your long term investments and wealth.

Diversification of your investments : build a portfolio with a low correlation with equity markets – Source: Bloomberg

FAQ Investing offshore : Answers to the most asked questions in 2021

💥 How do Millennials & Generation Z invest?

Whether you are a tax resident of your home country or an expat living abroad, you need to secure your savings and adopt a diversified investment strategy in order to be able to save throughout your professional life and grow your assets. The new generations (Millennials, Generation Z) have grown up in the age of the Internet and have access to much more information than in the past. We are used to get information via Google, compare services very quickly to make important choices for our future. We clearly know that the retirement we were promised will probably be just an illusion, that if we don’t take concrete action today, we will be left alone to face our problems.

🌎 Why investing offshore ?

Diversifying our savings, not putting our eggs in the same basket, using online banking, internet services to make the most of what is being done today is something that the new generation has in its genes. The 5-flag theory is a concept that some people are familiar with:

- You have a passport of a certain country

- You’re a tax resident in a country with lower taxes

- You own a company in a country that’s flexible for doing business

- You’re investing our savings in a high-growth country

- You live in a country with a low cost of living that allows you to enjoy an excellent quality of life.

If we structure our lives in this way, we are able to get the best out of each country by optimizing our savings, saving money which multiplies our results tenfold over the medium and long term. The question to ask yourself is: is the country where you have your passport the best country in which to make investments? If the answer is not YES, then you are in the right place.

💰 Self managed vs auto managed ?

Some people will recommend that you should rely on professionals to manage your investments. Others will tell you to do the research and take action on your own. There is no right or wrong answer: it depends a lot on your current knowledge, your interest in learning on your own and being rigorous in monitoring your investments. For example: using the services of a wealth manager is useful if you have a job that pays you a lot and if you don’t want to invest time to learn the basics of investing. On the contrary, training a minimum in long-term investment in the stock market will serve you well and after a few weeks of training and experimentation, you can be autonomous and take action yourself to manage your investments. It is up to you to choose which side you are on.

📈 What is the best long-term investment strategy?

Investing in the stock market is often a much decried word because people will be afraid to invest their money on unscrupulous online brokers or fall into the traps of asset managers who promise you huge profits without really being able to deliver these performances and returns. The approach that I am basing myself on, which is detailed in this article, is to use the strategy of Harry Browne and Ray Dalio to buy assets that balance each other. Having a diversified portfolio based on stocks, bonds, gold and cash. Such a portfolio will prosper in the good years without depreciating too much in times of crisis thanks to a monthly readjustment to be made every month. In terms of profitability? We are talking about an average annual profitability of 7% and a worst year at -3.7% during market corrections (statistics based on the last ten years). This strategy is based on the use of ETFs (Trackers) which allow to minimize entry and exit costs and therefore overall costs to maintain such an investment approach.

🚀 Best regulated and legit broker to invest abroad?

To develop a reliable investment strategy that will produce interest year after year, it is important to let your savings grow and reinvest the interest to benefit from the effect of the accumulated interest. This is why you will need to choose a regulated broker who has all the authorizations to allow you to freely invest on the financial markets. On a personal basis, I use Interactive Brokers, an American broker with very low fees and extreme reliability: your savings are in fact spread over several banks in order to be protected from a systemic crisis that could impact the financial world in the years to come.

How to take the first steps

As an exat living in the exotic region of Southeast Asia, the ideal first step is to train yourself or meet people who are in the same investment mindset. This can be done through investment events, networking evenings on the topic of personal finance.

Beware of scams and resellers

As an expat living in the exotic South East Asian region, the ideal first step is to speak to a registered financial advisor. However, there are many investment scams in this region, which calls for expats to conduct a thorough due diligence process before appointing a financial advisor to transfer a local pension to an offshore scheme or before providing the discretionary authority rights to execute investments on his or her behalf.

All advisors are bound to provide a clear breakdown of the fees involved and a failure to do so upon a request from a potential client should serve as the first warning sign of a bogus operation.

Investing early is the key as this allows returns to compound over a long period of time, which eventually results in a huge pot of savings at the end of the term. Following the footsteps of successful investors such as Warren Buffett, Peter Lynch, and Charlie Munger, could also be a worthwhile task for an expat.

Offshore bank account to secure your assets

If you work in the South East Asia region, you are probably aware of the problems faced by expatriates who live for several years: it is difficult to send money abroad. Countries such as Thailand, Cambodia or Vietnam, in order to protect their currencies, require supporting documents to make international transfers.

Regarding to this topic, we conducted a survey to explain how you can send money outside of Vietnam using electronic currencies. This is why many expatriates choose to open accounts abroad with brokers in jurisdictions such as Singapore or the United States.

Interactive Brokers: flexibility, cost and reliability

The solution I personally recommend and use is to open an account with Interactive Brokers in the United States or Citibank IPB in Singapore. The second solution requires a minimum deposit of US$200,000 which is not accessible to everyone, which is why Interactive Brokers is often the recommended solution to start with. It is a broker that allows you to buy ETFs worldwide and thus implement the strategy of the permanent portfolio.

The opening is online and will require proof of your residence in South East Asia. For those residing in South East Asia such as Vietnam, you will need to provide your tax identification number obtained from the tax authorities. You can read our article about taxes in Vietnam which tells you more about tax issues, residence and how to acquire your Vietnamese tax number through the services of an accountant.

Buy undervalued stocks as long term investment opportunities

The majority of financial market indexes are significantly overvalued due to the massive injection of money by institutions such as the FED in the United States and the BCE in Europe. An alternative strategy from buying ETFs that may suffer with a significant decline in the event of a financial crisis is to focus on undervalued assets. Thanks to fundamental and technical analysis, it is possible to identify companies or specific markets that are not leveraged and not overvalued yet. In the event of a possible correction in the financial markets in the coming months or quarters, your losses will be minimised and these assets will be less affected by adverse deviations.

This type of strategy is efficient through valuation analysis to highlight assets that are discounted from their true value. Most of those companies are also likely able to see their prices rise by several percent or defensive stocks for investors in the event of a market correction. For beginner investors, you can follow the advice of some value investors or analysts explaining their analysis based on metrics such as P/E ratio, High-Dividend yield or Lagging relative price performance compared to its industry peers may reveal an underperformance situation.

Investing and buy USA real estate

The strategy based on ETFs allows you to get an exposure on the increase of USA property prices through dedicated trackers. If you are more comfortable with the idea of owning a property and getting monthly rents, one service allows you to own a fraction of a property in the United States. This company is called RealT allows you to buy a part of a property and receive a daily fraction of the rent. The company uses a technology based on blockchain to simplify the management, purchase and sale of a share of a property between individuals.

Thus, you can invest some money today, receive rentals and sell your share a few months later. This is very flexible, reliable and backed by strong institutions; that’s why I recommend this service I am using for a few months in addition to my investment strategy on the financial markets.

Need more information on this subject? Join my private club to get in touch with me