Over the past decade, Vietnam has transitioned from a cost-driven outsourcing destination to a structured manufacturing ecosystem capable of supporting complex, multi-industry production. What was once perceived as a secondary alternative to China is now a strategic pillar in global supply chains.

Companies are no longer looking at Vietnam solely for cost reduction. Instead, they are leveraging the country for:

- supply chain diversification

- production flexibility

- access to specialized manufacturing clusters

- improved risk management

At MoveToAsia, we have supported companies across industries including furniture, garments, industrial metal fabrication, and construction materials. Across all these sectors, one pattern consistently emerges:

Success in Vietnam is not determined by the factory you choose, but by how you structure and manage your manufacturing process.

OEM and contract manufacturing in Vietnam require a hands-on, execution-driven approach that integrates supplier sourcing, technical validation, production monitoring, and quality control.

Understanding OEM, ODM & Contract Manufacturing in Vietnam

Before engaging with suppliers, it is essential to clearly understand the different manufacturing models available.

OEM (Original Equipment Manufacturing)

OEM is the most common model in Vietnam. In this setup:

- the buyer provides product design, specifications, and requirements

- the factory manufactures according to these instructions

This model is widely used across:

- furniture manufacturing

- garments and apparel

- metal fabrication

- consumer goods

OEM gives buyers full control over:

- design

- materials

- branding

However, it also requires:

- clear technical documentation

- strong project management

ODM (Original Design Manufacturing)

In ODM:

- the factory proposes existing designs

- the buyer adapts or brands them

This model is more common in:

- consumer products

- fast-moving goods

In Vietnam, ODM is less dominant compared to OEM, particularly in B2B industrial sectors.

Contract Manufacturing (Outsourced Production)

Contract manufacturing refers to a broader approach where production is outsourced to external manufacturers, often involving multiple suppliers.

In Vietnam, this typically includes:

- supplier sourcing

- production coordination

- quality control

- logistics management

In reality, contract manufacturing in Vietnam is rarely a single-factory relationship. It is usually a multi-supplier ecosystem.

Why Vietnam is a Strategic Manufacturing Hub

Competitive Cost Structure

Vietnam offers competitive labor costs, especially in labor-intensive industries such as:

- garments

- furniture

- assembly-based manufacturing

However, it is important to understand that Vietnam is not always the cheapest option. Instead, it offers a strong balance between:

- cost

- quality

- flexibility

Flexibility & Adaptability

Vietnamese factories are known for their ability to:

- adapt to custom designs

- handle smaller production volumes

- adjust production processes

This flexibility is particularly valuable for:

- product development

- pilot production

- mid-scale manufacturing

Export-Oriented Manufacturing

Vietnam has built strong export capabilities, with factories experienced in:

- EU and US compliance

- packaging standards

- international logistics

China +1 Strategy

Many companies are shifting part of their production to Vietnam as part of a diversification strategy.

Vietnam complements China by offering:

- alternative sourcing

- reduced geopolitical risk

- cost optimization

Key Industries for OEM Manufacturing in Vietnam

Vietnam’s manufacturing ecosystem is diversified and industry-specific.

Vietnam’s Top Product Categories for Contract Manufacturing

Furniture Manufacturing

Vietnam is one of the largest furniture exporters globally, with strong capabilities in:

- indoor furniture

- outdoor furniture

- hospitality furniture

Garments & Apparel

A mature industry with:

- large-scale production

- strong supply chain

- export experience

Metal & Industrial Fabrication

Includes:

- CNC machining

- welding

- metal structures

Consumer goods

FMGC and consumer goods covers a vast range from furniture and home goods to toys, footwear, and personal care products.

Construction & Building Materials

Includes:

- aluminum systems

- prefabricated structures

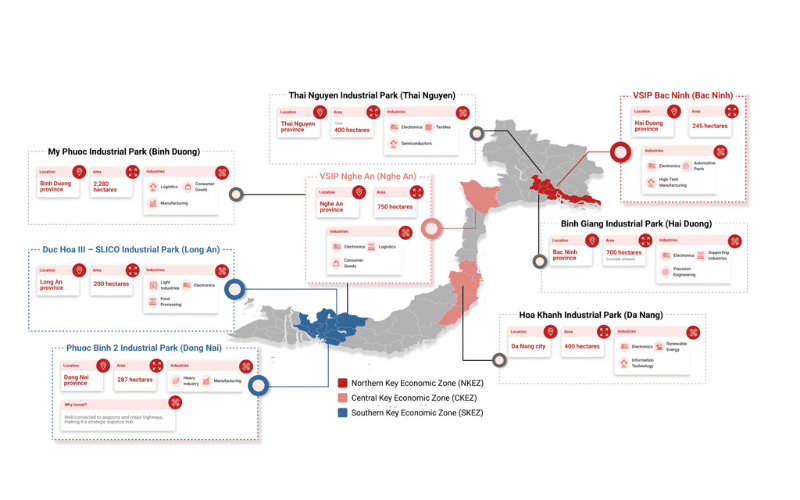

Vietnam Industrial Zone Overview and Key Regions

The North, centered around Hanoi and Hai Phong, has become Vietnam’s electronics manufacturing hub. This region benefits from proximity to China, developed infrastructure supporting electronics supply chains, and a growing pool of technical workers. It’s ideal for electronics, precision manufacturing, and products requiring sophisticated supply chains.

The South, dominated by Ho Chi Minh City and surrounding provinces, offers the country’s most developed infrastructure, largest labor pool, and best logistics connectivity. This region excels in textiles, footwear, furniture, and consumer goods. The business environment is generally more mature and international-friendly.

Central Vietnam, including Da Nang and surrounding areas, represents emerging manufacturing zones with lower costs than the North or South. This region is developing capabilities in automotive components, electronics assembly, and consumer goods. Infrastructure is improving rapidly but remains less developed than established zones.

How Contract Manufacturing Works in Vietnam

Prefer to watch rather than read? We’ve condensed the key insights of this guide into a quick video summary. Watch the breakdown to get an overview of the contract-manufacturing process before diving into the details.

Contract manufacturing in Vietnam is not a linear “supplier → production → delivery” process. It is a multi-step execution system that requires coordination, validation, and continuous monitoring.

The key difference compared to more mature ecosystems is that Vietnam requires active management at every stage.

Product Definition & Engineering

Everything starts with product definition. This is where most projects succeed or fail.

A clear product definition should include:

- detailed drawings (2D / 3D)

- material specifications

- tolerances and dimensions

- finishing requirements

- performance expectations

In practice, many buyers arrive in Vietnam with:

- incomplete drawings

- conceptual designs

- unclear material selection

This creates immediate issues:

- suppliers interpret differently

- quotations vary significantly

- production risks increase

Real Execution Insight

Vietnamese factories will rarely challenge unclear specifications aggressively. Instead, they may:

- assume missing details

- simplify production

- adapt materials

This is one of the main causes of:

- quality mismatch

- rework

- delays

Supplier Identification & Pre-Selection

Once the product is defined, the next step is identifying suitable suppliers.

This is not about finding “any factory,” but about matching:

- product requirements

- technical capability

- production capacity

In Vietnam, suppliers are often specialized:

- wood processing factories

- metal fabrication workshops

- upholstery specialists

- finishing subcontractors

Shortlisting Criteria

Suppliers should be evaluated based on:

- experience with similar products

- machinery and processes

- export track record

- responsiveness and communication

At this stage, it is common to shortlist 3–6 suppliers per category.

Factory Audit & Capability Validation

Before engaging a supplier, validation is essential.

This typically involves:

- on-site factory visits

- review of production processes

- quality control systems

- workforce capability

What Actually Matters On-Site

Instead of focusing only on presentation, the key is to assess:

- production flow (organized vs chaotic)

- actual machines used (not just listed)

- ongoing production (real projects)

- QC checkpoints

Sampling & Development

Sampling is not just a formality—it is a development phase.

This stage allows you to:

- validate feasibility

- test materials

- refine design

- identify production constraints

Iteration Reality

In Vietnam, sampling often requires:

- 2 to 4 iterations

- adjustments in materials or structure

- fine-tuning finishing

Key Risk

Skipping or rushing sampling leads to:

- mass production errors

- inconsistent quality

- higher long-term cost

Multi-Supplier Coordination

A major characteristic of manufacturing in Vietnam is supplier fragmentation.

A single product may involve:

- one factory for structure

- another for finishing

- another for assembly

Production Planning & Scheduling

Production must be planned carefully to avoid bottlenecks.

This includes:

- aligning supplier timelines

- confirming material availability

- securing production slots

Common Issue

Factories often accept orders without fully securing:

- materials

- internal capacity

Production Monitoring & Follow-Up

Once production starts, passive management is not sufficient.

Monitoring should include:

- regular updates from suppliers

- on-site visits when necessary

- tracking of key milestones

Why This Matters

Without monitoring:

- small issues become large problems

- delays are identified too late

- quality deviations go unnoticed

Quality Control Integration

Quality control should be integrated throughout the process:

- pre-production validation

- in-line inspection

- final inspection

Logistics & Delivery Coordination

Final delivery includes:

- packaging validation

- container loading

- shipping coordination

Key Insight: Contract manufacturing in Vietnam is not about finding a supplier. It is about building and managing a production system across multiple stakeholders.

Cost Structure of OEM Manufacturing in Vietnam

Understanding cost in Vietnam requires a multi-layer approach. Many buyers focus on unit price, but the real cost lies in the entire production ecosystem.

Raw Materials (30–60%)

Raw materials are the largest cost component.

They include:

- wood, metal, fabric, plastics

- imported components

- finishing materials

Key Reality

Vietnam imports a significant portion of its raw materials.

This means:

- price volatility linked to global markets

- dependency on external suppliers

- fluctuating quotation validity

Labor Cost (10–25%)

Labor remains competitive in Vietnam, particularly for:

- assembly

- manual processes

- finishing work

Important Nuance

Lower labor cost does not always mean lower total cost.

Factors such as:

- productivity

- skill level

- rework

can impact final pricing.

Tooling & Development Cost

For custom products, tooling is often required.

This includes:

- molds

- jigs

- production setup

Cost Range

- simple tooling: $300–$1,000

- complex tooling: $1,000–$5,000+

Manufacturing & Processing (15–30%)

This includes:

- machining

- cutting

- welding

- assembly

Surface Treatment & Finishing (10–20%)

Finishing is often outsourced in Vietnam.

Includes:

- painting

- coating

- anodizing

- polishing

Packaging & Logistics

Includes:

- packaging materials

- palletization

- container loading

Cost Comparison Insight (Vietnam vs China)

Vietnam can be:

- 5–15% cheaper for labor-intensive products

- similar or slightly higher for complex products

Vietnam vs China for Contract Manufacturing

Choosing between Vietnam and China is no longer a simple cost comparison. It is a strategic decision that depends on product type, scale, and long-term supply chain objectives.

Many companies today are not replacing China entirely, but instead building a dual sourcing strategy, where Vietnam plays a complementary role.

Industrial Maturity & Supply Chain Integration

China remains the most advanced manufacturing ecosystem in the world. Vietnam, by contrast, operates in a more fragmented ecosystem.

When comparing Vietnam vs China in terms of pricing, it is critical to look at:

- total landed cost

- not just unit price

In some cases:

Vietnam can be 5–15% cheaper. In others, it can be 5–10% more expensive, depending on material dependency.

Overview of Vietnam vs China

Choosing between Vietnam and China depends on your product, supply chain complexity, and long-term strategy. Below is a simplified comparison. For a deeper analysis, refer to our full guide.

Core Comparison

| Criteria | Vietnam | China |

|---|---|---|

| Cost (Labor) | Lower labor cost, strong advantage for manual production | Higher labor cost but offset by productivity |

| Total Cost (Reality) | Competitive but depends on coordination and imports | Often optimized due to integrated ecosystem |

| Manufacturing Model | Distributed (multi-supplier ecosystem) | Highly integrated (end-to-end production) |

| Flexibility | High (good for custom, smaller batches) | Medium (optimized for scale) |

| MOQ (Minimum Order) | Lower, more adaptable | Higher, especially for large factories |

| Lead Time | Medium (depends on coordination) | Faster (efficient supply chain) |

| Supply Chain | Fragmented, some reliance on imports | Dense, local, highly structured |

| Quality Consistency | Variable (depends on management) | More standardized and predictable |

| Product Complexity | Best for simple to mid-complex products | Strong for complex and technical products |

| Industrial Maturity | Growing rapidly | Very mature ecosystem |

| Scalability | Good but depends on supplier network | Excellent for large-scale production |

| Risk Diversification | Strong (China+1 strategy) | Higher dependency if used alone |

Contract Manufacturing Fit

| Use Case | Best Country |

|---|---|

| Labor-intensive products (furniture, garments, assembly) | Vietnam |

| Complex multi-component products | China |

| New product / pilot production | Vietnam |

| Large-scale industrial production | China |

| Supply chain diversification | Vietnam (+ China hybrid) |

Not sure which country fits your project? Our team helps structure and execute your manufacturing strategy across Vietnam and China.

When to Choose Vietnam vs China

Vietnam is better when:

- you need flexibility

- you are developing a product

- you want mid-scale production

- you want to diversify supply chain

China is better when:

- you need large-scale production

- your product requires integrated supply chain

- speed is critical

In practice:

Most companies benefit from a hybrid strategy:

- China for scale

- Vietnam for flexibility and diversification

Key Risks & Challenges in OEM Manufacturing in Vietnam

Manufacturing in Vietnam offers strong opportunities, but it also presents operational challenges that must be understood and managed proactively.

Supplier Fragmentation & Multi-Vendor Complexity

Unlike China, where a single factory can often handle multiple processes, Vietnam’s manufacturing ecosystem is more segmented.

A single product may require:

- one supplier for structure

- another for finishing

- another for assembly

This creates:

- coordination complexity

- dependency between suppliers

Real impact:

- delays if one supplier falls behind

- quality inconsistency between components

- increased project management effort

Inconsistent Quality Across Suppliers

Quality levels in Vietnam can vary significantly from one factory to another.

Even within the same factory:

- consistency between batches can fluctuate

- finishing standards may differ

Common issues include:

- surface finishing inconsistencies

- dimensional deviations

- material substitution

Communication & Technical Interpretation Gaps

Communication challenges are not just about language, but about technical understanding.

Factories may:

- interpret drawings differently

- adjust specifications without full alignment

- assume certain tolerances

Typical situations:

- a design detail is simplified during production

- material is substituted without approval

- finishing is interpreted differently

Production Delays & Capacity Constraints

Vietnamese factories often operate with:

- limited excess capacity

- strong dependency on workforce availability

Material Dependency & Supply Chain Risks

Many Vietnamese manufacturers rely on imported materials, especially from:

- China

- Korea

- Taiwan

Limited Vertical Integration

Vietnam factories are often specialized rather than fully integrated.

This means:

- fewer “one-stop” solutions

- more need for coordination

Compliance & Documentation Gaps

Not all factories have the same level of:

- documentation

- compliance

- certification

Scaling Challenges

Vietnam is strong in small-to-mid scale production, but scaling rapidly can be challenging.

Issues include:

- limited machinery

- workforce constraints

- capacity saturation

Strategic Takeaway : Vietnam is not a “plug-and-play” manufacturing destination. It is a high-potential ecosystem that rewards structured execution.

How to Select the Right Contract Manufacturing Partner in Vietnam

Selecting the right manufacturer in Vietnam is one of the most critical decisions in the entire sourcing process. Unlike more mature manufacturing ecosystems, Vietnam requires a more structured and hands-on approach to supplier selection.

The biggest mistake companies make is selecting a supplier based solely on price or initial responsiveness.

In reality, a strong supplier is not defined by how quickly they reply or how competitive their quotation is, but by their ability to consistently deliver quality products within agreed timelines.

Understanding Supplier Types in Vietnam

Before even starting supplier selection, it is important to understand that not all factories operate the same way.

In Vietnam, you will typically encounter:

- Large export-oriented factories

These suppliers work with established international clients and operate with structured processes. They offer better consistency and quality systems, but often require higher MOQs and are less flexible for small or early-stage projects. - Mid-sized manufacturers

These factories are often the most balanced option. They offer reasonable capacity, flexibility, and are more open to customization and product development. - Small workshops and subcontractors

These suppliers can be very flexible and cost-competitive, but they may lack:- structured quality systems

- documentation

- scalability

Choosing the right category depends on your project stage, volume, and complexity.

Technical Capability vs Commercial Attractiveness

A common trap is to prioritize commercial factors such as price or payment terms over technical capability.

However, in Vietnam, technical capability should always come first.

This includes:

- machinery and equipment

- production processes

- experience with similar products

- workforce skills

A factory that cannot technically execute your product will create:

- delays

- quality issues

- hidden costs

Factory Evaluation

Factory visits remain one of the most effective ways to evaluate a supplier.

During a visit, attention should be paid to:

- Production flow

Is the factory organized, or chaotic? A well-structured production flow usually indicates better process control. - Machinery and equipment

Are machines adapted to your product requirements, or outdated and repurposed? - Workforce skill level

Skilled labor is a key factor in consistency and finishing quality. - Quality control practices

Is there a dedicated QC team, or is quality handled informally?

These observations provide insights that cannot be captured through emails or quotations.

Sampling as a Validation Tool

Sampling is often misunderstood as a simple validation step. In reality, it is a critical testing phase.

A proper sampling process should:

- validate technical feasibility

- test materials and finishes

- identify production challenges

It is also the moment to evaluate:

- responsiveness of the supplier

- ability to adapt

- attention to detail

Multiple iterations are common and should be expected.

Evaluating Reliability & Communication

A supplier’s ability to communicate clearly and consistently is often underestimated.

In Vietnam, communication gaps can arise from:

- language differences

- technical interpretation

- cultural differences

A reliable supplier should:

- ask clarifying questions

- confirm specifications

- provide updates proactively

Poor communication at the beginning usually leads to bigger issues during production.

Production Capacity & Scalability

Another critical factor is the supplier’s ability to handle your current and future volumes.

Questions to consider include:

- What is the factory’s current capacity utilization?

- Can they scale production if needed?

- Do they rely on subcontractors?

A factory that is too small may struggle to scale, while a factory that is too large may not prioritize your project.

Financial Stability & Long-Term Viability

Supplier stability is often overlooked but is essential for long-term partnerships.

Indicators include:

- years of operation

- client portfolio

- export history

OEM vs Direct Factory vs Sourcing Partner

One of the most common questions companies face when entering Vietnam is whether to work directly with factories or through a sourcing partner.

This decision has a significant impact on:

- cost

- risk

- execution complexity

Working Directly with Factories

Working directly with manufacturers is often perceived as the most cost-effective approach.

It offers:

- direct communication

- no intermediary margin

- stronger supplier relationship (in theory)

However, this approach assumes that the buyer is capable of managing:

- supplier selection

- technical validation

- production coordination

- quality control

Practical Challenges

In Vietnam, working directly with factories can become complex due to:

- supplier fragmentation (multiple vendors involved)

- limited internal coordination within factories

- lack of standardized processes

Buyers often underestimate the amount of management required.

The Hidden Cost of “Direct Sourcing”

While direct sourcing may reduce visible costs, it can increase hidden costs such as:

- production delays

- quality issues

- rework

- miscommunication

These costs can quickly outweigh initial savings.

Role of a Sourcing Partner

A sourcing partner does not replace the factory. Instead, they act as a layer of structure and coordination.

Their role typically includes:

- identifying and qualifying suppliers

- managing sampling and development

- coordinating production across multiple factories

- ensuring quality control

- handling communication and issue resolution

When a Sourcing Partner Adds Value

Working with a sourcing partner is particularly beneficial when:

- entering Vietnam for the first time

- managing multiple suppliers

- dealing with complex or customized products

- lacking internal resources for on-ground management

In these situations, the sourcing partner reduces risk and improves execution.

Hybrid Approach: Best of Both Worlds

Many companies adopt a hybrid model:

- direct relationship with factories

- supported by a sourcing partner on the ground

This allows them to:

- maintain control

- benefit from local expertise

- reduce operational risk

Long-Term Perspective

As companies scale in Vietnam, they may gradually build internal capabilities and manage certain aspects directly.

However, even experienced buyers often continue to rely on local partners for:

- quality control

- supplier expansion

- problem-solving

Top 10 OEM & Contract Manufacturing Companies in Vietnam

Vietnam does not operate like a centralized manufacturing ecosystem where a single supplier can cover all needs. Instead, companies typically work with specialized manufacturers depending on product category, materials, and technical requirements.

Below is a curated list of manufacturers across key sectors in Vietnam, reflecting the diversity of OEM and contract manufacturing capabilities in the country.

1. Scansia Pacific

A well-established furniture manufacturer with strong export capabilities, Scansia Pacific specializes in indoor and outdoor wooden furniture for international markets. The company operates large-scale production facilities and has experience working with global brands, particularly in Europe and the US. Their strengths lie in mass production, standardized quality systems, and the ability to handle high-volume orders. However, their structure is more suited to established buyers rather than small or highly customized projects.

2. AA Corporation

AA Corporation is one of Vietnam’s leading companies in high-end furniture and interior fit-out, particularly for hospitality and commercial projects. They offer a fully integrated approach, covering design, manufacturing, and installation. Their capabilities extend beyond standard OEM production into project-based execution, making them particularly relevant for hotels, retail spaces, and premium developments. Their scale and positioning mean they typically focus on larger contracts rather than smaller production runs.

3. An Phuoc Garment

An Phuoc is a well-known garment manufacturer in Vietnam, producing apparel for both domestic and international brands. The company operates with structured production systems and has strong experience in OEM manufacturing for clothing lines. Their capabilities include fabric sourcing, pattern development, and large-scale garment production. They are best suited for brands looking for consistent quality and established production processes.

4. TNG Investment & Trading

TNG is one of Vietnam’s largest garment exporters, working with major international brands. The company offers full-package manufacturing, including material sourcing, production, and export. Their scale allows them to handle large volumes efficiently, but they are generally less flexible for smaller orders or early-stage product development.

5. Hòa Phát Group

Hòa Phát is one of Vietnam’s largest industrial groups, with strong capabilities in steel production and metal fabrication. While primarily focused on raw materials and large-scale industrial products, the group plays a key role in Vietnam’s manufacturing ecosystem. Their scale and infrastructure make them relevant for projects involving steel structures, construction materials, and industrial supply.

6. Minh Nguyen Supporting Industry

This company focuses on precision engineering and metal component manufacturing, including CNC machining and industrial parts. They work with international clients requiring technical precision and customized components. Their strength lies in engineering capability and flexibility for specialized projects rather than mass production.

7. Duy Tan Plastics

Duy Tan is a major plastic manufacturer in Vietnam, offering OEM production for packaging, household goods, and industrial plastic components. The company has strong injection molding capabilities and serves both domestic and export markets. Their production scale and experience make them suitable for large-volume plastic manufacturing projects.

8. Rang Dong Light Source & Vacuum Flask

Rang Dong is a leading manufacturer in lighting and household products. The company combines industrial production with product development capabilities, offering OEM services for lighting systems and consumer goods. Their structured operations and strong domestic presence make them a reliable partner for certain product categories.

9. Thaco Industries

Part of the THACO Group, this company has expanded into mechanical engineering and industrial manufacturing. Their capabilities include metal fabrication, automotive components, and industrial equipment. They represent Vietnam’s move toward more advanced manufacturing sectors and integrated production capabilities.

10. Viet Tien Garment Corporation

Viet Tien is one of Vietnam’s most established garment manufacturers, with decades of experience in export markets. The company offers OEM production with structured quality systems and strong operational capacity. They are particularly suited for brands looking for reliable, large-scale garment manufacturing.

Disclaimer: Vietnam’s manufacturing ecosystem is highly fragmented. A single supplier may not be able to handle all aspects of your project.

While the companies listed above represent strong manufacturing capabilities in Vietnam, it is important to understand that:

- Not all manufacturers are accessible to new clients

- Many require minimum order quantities (MOQ) that may be too high for certain projects

- Some focus on long-term partnerships and may not accept smaller or one-off orders

- Communication and responsiveness can vary depending on the factory and project scope

Our Recommendation

There is no “one-size-fits-all” factory in Vietnam.

Successful OEM projects typically require:

- structured production management

- careful supplier selection

- multi-supplier coordination

Rather than trying to approach multiple factories directly without a clear structure, companies benefit from working with a partner who understands:

- how to identify the right suppliers

- how to validate capabilities

- how to manage production across different vendors

- how to ensure quality and timelines

At MoveToAsia, we support companies in navigating Vietnam’s manufacturing ecosystem by acting as an on-ground partner throughout the entire process—from supplier sourcing to production management and delivery.

This ensures that projects are not only launched successfully, but also executed efficiently and reliably.

Q&A about OEM & Contract Manufacturing in Vietnam

How does OEM manufacturing actually work in Vietnam?

OEM manufacturing in Vietnam is a structured but hands-on process that goes far beyond simply placing an order with a factory. In most cases, companies begin by defining their product specifications in detail—this includes materials, dimensions, tolerances, and performance requirements. Based on this, suppliers are identified and evaluated according to their technical capabilities.

What makes Vietnam different from more mature ecosystems is that production is often not handled by a single fully integrated factory. Instead, multiple suppliers may be involved across different stages such as fabrication, finishing, and assembly. This means that coordination becomes a critical part of the process.

Sampling is typically required before production, and it often involves several iterations. Once validated, production is launched, but it still requires ongoing monitoring to ensure consistency. Quality control is usually performed both during and after production, before shipment.

What types of products can be manufactured in Vietnam?

Vietnam offers a wide range of manufacturing capabilities, but its strengths are concentrated in specific industries.

It is particularly competitive in furniture production, garments and textiles, metal fabrication, and construction materials. Within these sectors, the country has developed strong export-oriented capabilities and supplier networks.

More complex or highly technical products can also be manufactured in Vietnam, but they often require a more structured sourcing approach and sometimes involve imported components or hybrid supply chains.

Is Vietnam cheaper than China for manufacturing?

The assumption that Vietnam is always cheaper than China is not entirely accurate. While labor costs in Vietnam are generally lower, the total cost of production depends on multiple factors, including material sourcing, production efficiency, and supply chain structure.

In some cases—particularly for labor-intensive products—Vietnam can offer a cost advantage of around 5–15%. However, for products that rely heavily on imported materials or complex processing, costs may be similar or even slightly higher than in China.

It is therefore more relevant to compare total project cost rather than unit price. Factors such as delays, quality issues, or inefficient coordination can have a larger financial impact than small differences in production cost.

What is the minimum order quantity (MOQ) in Vietnam?

Minimum order quantities in Vietnam vary significantly depending on the industry, product complexity, and type of factory.

Compared to China, Vietnamese manufacturers are generally more flexible when it comes to MOQs. This is especially true for small and mid-sized factories that are open to:

- product development

- pilot production

- smaller batch manufacturing

However, larger export-oriented factories may still require higher volumes to optimize their production lines.

How long does contract manufacturing take in Vietnam?

Production timelines in Vietnam depend on several stages, including sourcing, sampling, production, and logistics.

For most projects, the full process typically ranges from 8 to 16 weeks. Sampling alone can take several weeks, especially if multiple iterations are required. Production timelines then depend on factory capacity, order volume, and material availability.

Delays can occur if materials are imported or if production is split across multiple suppliers. This is why proper planning and coordination are essential.

Do I need to visit factories in Vietnam?

While it is technically possible to manage sourcing remotely, visiting factories remains highly recommended, especially for new projects or new suppliers.

Factory visits allow buyers to:

- validate production capabilities

- assess working conditions and organization

- build direct relationships with suppliers

In many cases, on-site visits reveal details that are not visible through documentation or online communication. They also help align expectations and improve communication during production.

What are the biggest risks when manufacturing in Vietnam?

The main risks in Vietnam are not necessarily related to cost or capability, but to execution.

One of the most common challenges is supplier fragmentation, where different parts of the production process are handled by different vendors. This increases coordination complexity and requires structured management.

Quality inconsistency is another frequent issue, especially if suppliers are not properly validated or if quality control is not implemented during production. Communication gaps can also lead to misinterpretation of specifications, particularly for technical products.

Can I work directly with factories, or do I need a sourcing partner?

Many buyers initially aim to work directly with factories to reduce costs. While this approach can work in certain cases, it often becomes challenging in Vietnam due to the need for coordination, validation, and ongoing management.

Working directly with a factory may be suitable for:

- simple products

- repeat orders

- established supplier relationships

However, for new projects or more complex production, working with a sourcing partner can help manage:

- supplier selection

- technical validation

- production monitoring

- quality control

How do I ensure product quality in Vietnam?

Ensuring quality requires more than a final inspection before shipment. It must be integrated throughout the production process.

This typically includes:

- validating samples before production

- conducting in-line inspections during production

- performing final quality checks before shipment

Clear specifications and technical documentation are also essential to avoid misinterpretation. Without this, even a capable factory may deliver inconsistent results.

Is Vietnam suitable for long-term manufacturing partnerships?

Vietnam is increasingly becoming a long-term manufacturing destination for international companies. Its growing industrial base, export experience, and adaptability make it suitable for sustained production partnerships.

However, long-term success depends on:

- selecting the right suppliers

- building strong relationships

- maintaining consistent quality standards

Companies that invest in understanding the local ecosystem and structuring their operations properly are able to scale production effectively over time.

Final Insight

Vietnam continues to strengthen its position as a global manufacturing hub.

Companies that adopt a structured approach to OEM manufacturing can benefit from:

- scalable production

- cost optimization

- supply chain diversification

Most companies entering Vietnam focus on finding the “right factory.”

👉 In reality, success comes from building the right system around the factory:

- sourcing

- validation

- coordination

- quality control

This is exactly where an on-ground partner becomes critical—not to replace factories, but to ensure that the entire process works efficiently from start to finish.