So you’ve been looking around trying to find the best country and city to set-up your business and found Vietnam was a good choice due to its growing economy. Maybe you have been living in Vietnam for a while and want to have your own business and leave the expat life. Having your own business is great in letting you have financial freedom but it also has its struggles. It is even harder in a foreign country and you can be vulnerable to a lot of scams and mistakes.

Knowing the types of companies available to you will help you understand what suits your needs more. It will also help you in not getting too many fees due to your investment in Vietnam. Trying to set-up a business is hard but not knowing the language and not having an abundance of information about Vietnam foreign company types can make things worse.

🚨 Mistakes to avoid, honest pros / cons on the different type of set up, pay the right price to open your business 🤑 . So many questions that I am replying on a dedicated video.

Find below this video 🎥 where I share with you everything you need to know if you are looking to set up a business in Vietnam 👇.

In this article, we will help you know everything there is to know about the type of companies in Vietnam that are available, especially for foreign nationals. This will hopefully help you set up your foreign company in Vietnam.

Why Set-Up a Business in Vietnam ?

Before we dive into the nitty-gritty of Vietnam foreign companies, it’s best if we first give you a short run-down of why Vietnam is an investment haven at the moment. To illustrate these concepts, let’s take a look at 5 business sectors and opportunities that are booming in Vietnam in recent years.

In this video, we talk about the textile industry, exports, IT, the F&B and tourism sectors. These 5 industries have shown resilience or are expected to growth in the next upcoming years.

Vietnam is a growing economy and is projected to be one of the biggest economies in Asia by 2050. It has an economic growth of 4% to 8%. This is a huge difference to a lot of developed countries who are now seeing slow or even stagnant growth. Another reason to set-up your business in Vietnam now is the increased purchasing power of the middle class. This means that you will expect more and more customers and/or users. Owning a business (being a shareholder or working for your company) will allow you to obtain a working contract, pay your taxes and get a residence card. It is therefore a sustainable solution to work in Vietnam, be officially registered as a resident, pay your taxes and be able to live there for several years.

However, there are some downsides to it. For one, 100 % foreign-owned companies have stricter guidelines which are usual in most countries : you will have more intensive accounting policy, more frequent declarations and checks from the Vietnamese government tax department.

👉 Do you have a business project in Vietnam? Get in touch with us

Types of Companies

Vietnam now offers great choices for Vietnam company foreign ownership. They have also started to be laxer in their rules about foreigners owning and investing in the country. This is great news for anyone trying to have a piece of the growing Vietnamese economy.

There are primarily six principal types of business licenses in Vietnam. These are :

- Business cooperation;

- Joint venture;

- 100% foreign-owned company;

- Branch of an existing foreign company; and

- Representative office of an overseas company.

Business Cooperation (Limited Liability Company)

A limited liability company is a company type where it that established through capital contributions to the company. This contribution is then treated as equity. The usual structure of this kind of company consists of a members’ council, the chairman, general director, and a controller.

In Vietnam, this kind of company can be 100% owned by foreigners or a joint-venture between foreigners and at least one local investor.

Joint Venture

A joint venture is the only type of company that is allowed to sell shares in Vietnam. This type of company is required to have at least three shareholders and there is no maximum number of shareholders. The shares correspond to the capital that the person has invested in the company.

A joint venture type of company in Vietnam can be 100% foreign or can be a joint venture between locals and foreigners.

Local Branch

This is not a common form of foreign direct investment and is only permitted in a few sectors. The local branch could mean that it is a franchise of a foreign company in Vietnam. Usual examples would be clothing chains or food chains. This type of business allows investors to conduct commercial activities in Vietnam.

Representative Office

A Representative Office is not allowed to conduct any commercial activity in Vietnam. This means that this type of company can only participate in activities like searching for trade partners or investors in Vietnam and implement contracts with the partner local company. Aside from this, they also have the power to supervise Vietnamese projects of the main foreign company.

This is a great choice for foreign companies who are just in their exploratory phase in Vietnam. This allows them to search for partners and also test the Vietnamese market.

100% Foreign-Owned Company

A 100% Foreign-Owned Vietnamese Company is, as its name suggests a company that has no local owners or investors. This type of company requires that you obtain an Investment Registration Certificate through the proper channels.

A 100% Foreign-Owned Vietnamese Company is, as its name suggests a company that has no local owners or investors. This type of company requires that you obtain an Investment Registration Certificate through the proper channels.

Local Vietnamese Company

Your company can be considered a local company if foreign investors only own 51% of the company. This type of company is treated the same way as 100% of Vietnamese owned companies.

Which Type is the Best for You?

Choosing the type that suits you the most is key in getting the most out of your investment. Of course, if you already have a big company abroad then your choice is already made for you. But for first-time business owners or those who are venturing in a new industry or company, it can be a bit trickier.

Although Vietnam allows 100% foreign ownership, having a local company will be a strategic option for you. A company is considered local if at least 49% of the company is owned by a local.

🎥 Video: set up a business in Vietnam – my review

💡 Many of you have asked me for information about the type of business I am running in Vietnam. And of course, as I’ve been living there for several years, I decided to record a video in depth about this topic.

I am sharing you about the advantages of investing in Vietnam and set up a business, how to avoid mistakes that ruin your chances of having a flexible and sustainable structure that last, the hottest industries you can jump into. I digest for you the different types of structures, the pros and cons and which one I recommend for your situation.

Opening a company in Vietnam may imply a lot of paperwork for foreign investors. Feel free to get the copy of our e-book and get in touch with us to get some help.

👉 Do you want to open a business in Vietnam? Get in touch with me today

Local vs Foreign Business

The main advantage of having a local business is that you can get your foreign company registration in Vietnam faster.

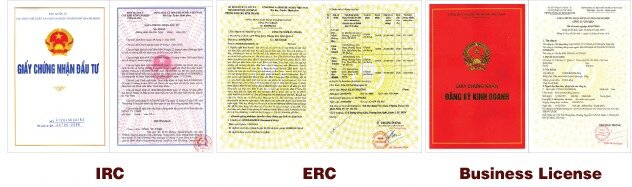

All foreign-owned companies must acquire the Investment Regulation Certificate (IRC) from the Department of Planning Investment (DPI). The process is pretty straightforward but it takes a minimum of 20 days to get approved! This can be a bit problematic especially if you are just in Vietnam for a couple of days. The process gets a bit trickier and lengthy if you are in certain industries such as gyms, online teaching, and spas.

However, if your company is less than 51% owned by a foreigner and is therefore considered a local company, you no longer need to get an IRC. You can go straight to registering your business in Vietnam and obtain your Business Registration Certificate (BRC).

Having a local company significantly reduces your registration period. It also saves you from all of the hassles that come with being a foreign-owned company. This is also considered the best choice for industries which do not have foreign ownership regulations (gyms, spas, and online teaching).

Q&A : Set up a business in Vietnam as a foreign entrepreneur

🇻🇳 Types of company in Vietnam ?

Vietnam allows a foreigner to own 100% of the capital as a 100% foreign LLC. This is the first type of structure widely promoted: the 100% foreign limited company. This structure is a bit more complicated to open and maintain. This is why the majority of entrepreneurs choose to involve a Vietnamese partner as an investor. You can either share the capital with a local person (49%-51%) or even choose a 100% local capital thanks to a Vietnamese nominee. Entrepreneurs may also consider using a Representative Office if they already own a company overseas. Each type of business has its advantages and disadvantages and this is one of the topics explored in this article and video.

💰 Cost of starting a business in Vietnam and registration fees

Since lawyer quotations range from single to quadruple, you should consult several law firms to compare rates and make sure you are paying the right price. As an example, for a Limited Company, obtaining a work permit for a foreigner and a two-year temporary residence card, expect having a pricing from $1,000 to $2,000 (excluding share capital). Comparing to other countries in South East Asia, Vietnam may be the only one in the region to be so favorable and with attractive registration fees and cheap costs to set up a business there.

🥇 Best set up to incorporate a company in Vietnam (2022)

There is no one type of structure that fits all types of projects. Depending on whether you are already an entrepreneur with a legal structure abroad and depending the sector you wish to enter in (with or without having Vietnamese investors), the recommendations will be different. This is why we invite you to watch the video dedicated to this subject (on the page) in order to have a better knowledge about the pros and cons of each type of company and know which one suits your situation.

📝 License to do business in Vietnam

Some activities such as opening a restaurant, bar or coffee-shop require an F&B (Food and Beverage) license. Importing, exporting and distributing some specific products also require to the get a license when setting up your company. However, if you are providing services, such as consulting with a light structure such as a limited liability company, these licenses are not mandatory, which allows you to start quickly.

How to Register a Foreign Company?

Now that you know the different types of businesses, you probably already have a clear picture of which type is the best for you at the moment. The next step is to know how to register a foreign company in Vietnam.

The steps on how to register a foreign company in Vietnam differs depending on whether you are considered as local or a foreign company. We have mentioned this briefly but we will now go into further detail.

Registering a Non-Local Company

Step 1. Acquiring Investment Regulation Certificate (IRC)

All foreign companies need to apply for an IRC from the DPI. This process usually takes a minimum of 20 days for you to get your certificate.

Note that all foreign ownership of businesses is regulated through the World Trade Organization. Some specific countries also have trade treaties with Vietnam. However, these regulations are only for certain industries.

There are some businesses that do not have a specific treaties concerning them. As we mentioned, common examples of these kinds of businesses are gyms, spas, and online teaching. If you will be operating any of these businesses, it can be harder and take longer for you to acquire your IRC.

Step 2. Obtain Licensing

After 20 or so days, you will receive your IRC. Once you have this, you would need to obtain licensing. Licensing takes 18 days. However, in practice, it is usually longer.

Step 3. Acquire Business Registration Certificate

The last step before doing your tax registration is acquiring your BRC. This can usually be done at the same time as when you get your license.

Registering a Local Company

Step 1. Acquire Business Registration Certificate

As what we have already mentioned, local companies do not need to get an IRC so you can go straight to getting your BRC. This significantly cuts your registration time!

Step 2. Tax Registration

Once you have your BRC, you can now register your company for tax paying. This is a very important step!

Step 3. Licensing

Licensing for local companies is not mandatory. Only specific types of businesses are required to have it. Double check if your company falls under that category.

Requirements

Registering your company as a local company is very easy and could be the best option for you. This is especially true if you are a small business owner or just started doing business in Vietnam. Below is a list of a more detailed requirement list to be a Vietnam local company.

Less than 51% Foreign Owned

This is obviously the number one requirement. Your company should be owned at 49% by a Vietnamese local. The most common type of companies that would be set-up under this are limited liability companies. As we mentioned, limited liability companies are companies composed of members who have capital as their stake in the company.

Licensing for Certain Industries

Again, not all local industries require licensing. Industries that do not require licensing such as consulting companies and tech development companies can operate as soon as you receive your BRC.

However, if you will be setting a Vietnam retail company or an English school, you would need to apply a licensing that all foreigners need to get. Licensing takes 18 or more days to be released.

Registered Address

You need a registered address where you will be operating your business. The great thing about Vietnam is that it could be a virtual address. This is helpful for online companies and smaller consulting companies.

Retail businesses, of course, need a retail space where you will be selling your goods. You need a physical address ready when you register.

Vietnam is a great place to invest at the moment. The country is booming and you will for sure see a return to your investments. It is also so much easier to set-up a foreign owned company in Vietnam now compared to the past, so you should take advantage of this great period!

We hope that our article helped you in knowing the different foreign company types as well as which one is the best for you. If you think we left out something please comment it down below! All questions are also very welcome and we will try our best to answer it quickly!